From the Expense, we strive so you’re able to generate financial decisions with full confidence. Although of one’s factors assessed come from all of our Services, and additionally people with and this we are affiliated and people who make up you, our critiques should never be dependent on him or her.

Skyrocket Home loan and its particular user Skyrocket Loans provide cash-away refinancing and private money, so that they has actually choices for residents and you will non-property owners the exact same.

Really does Skyrocket Mortgage Offer Domestic Security Funds or HELOCs?

Skyrocket Financial and its particular connected enterprises bring a couple solutions so you can family security finance and HELOCs that will be helpful in a few examples. These types of selection try bucks-out re-finance money and private funds.

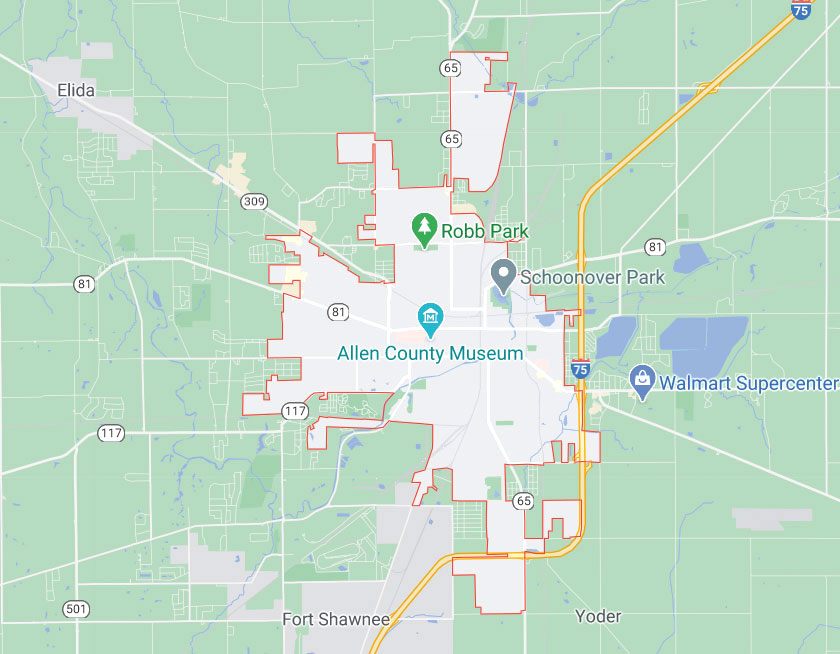

Rocket Home loan would depend into the Detroit, MI, but works in every fifty states. They are part of a family away from businesses that provides mortgage loans and private funds as well as domestic and you may vehicles to acquire characteristics. Skyrocket Financial had previously been also known as Quicken Funds.

According to the organizations web site, Rocket Financial ‘s the largest mortgage lender in the us. Within the 2020, it finalized $320 mil value of mortgages.

Overall, the organization features twenty six,000 team and you may works workplaces into the four various other says. Their reach is actually nationwide, through exactly what the team refers to given that the initial totally on the web home loan feel.

That it on the web importance allows financial people doing the entire processes instead dealing in person with salespeople otherwise lenders. However, the program does offer entry to credit masters when wished.

Cash-out refinancing

Such as a property equity mortgage, a finances-away refinance loan try a way of making use of new collateral when you look at the a property discover bucks. not, instead of just credit against guarantee, cash-out refinancing comes to replacing new homeowner’s most recent home loan with a more impressive mortgage. You to huge loan lets consumers to restore its established financial and you can make use of the remaining cash with other purposes.

Cash-aside refinance financing tends to be a far greater replacement for home equity funds in situations where this new loan’s interest rate is significantly below compared to the existing home loan and the amount of dollars taken out is an enormous part of the total matter borrowed. How come it issues is that there are surcharges for the money-aside refinancing, and they work on between .375% and you can 3.125% of your whole amount borrowed not simply the money out. A beneficial step 3% commission on good $300,one hundred thousand home loan was $nine,000. It will not add up while you are just looking for $20,one hundred thousand bucks.

Cash-out refinancing might not be a fees-active alternative to property guarantee loan in the event your new interest price is not significantly less than the old you to definitely. That is because the new fees employed in providing an alternative home loan you are going to make this an expensive technique for accessing house security.

Signature loans

Another alternative provided by Rocket Financial are a consumer loan. Personal loans could be shielded otherwise unsecured. Secured makes them supported by collateral, whenever you are personal loans count regarding the newest borrower’s credit rating and you will financial predicament.

Unsecured loans generally have high interest rates than simply mortgage loans. Particular consumer loan providers carry out render costs you to definitely contend with the individuals away from home guarantee fund, in case the borrowers are extremely accredited. And based on Federal Set aside investigation, personal loan prices are often less costly than simply credit to the a credit card. This means personal loans http://www.availableloan.net/installment-loans-tn/nashville are a fees-effective supply of borrowing to have borrowers that simply don’t have a substantial quantity of security in a house.

Delivering an unsecured loan would depend significantly to the borrower’s credit history and you can finances. There are usually charge associated with the starting that loan, and come up with unsecured loans shorter costs-effective to own a small amount.

Rocket Mortgage Home Equity Financing

Just like the Skyrocket Financial will not already provide domestic security loans, an alternative way out-of experiencing brand new guarantee from inside the a house for the money try a finances-aside home mortgage refinance loan.