Whether you’re against house repair expenditures, educational costs can cost you, or another quick financial you would like, it’s pertinent to collect the fresh new capital out-of an appropriate resource to help you avoid big taxation and capital get back ramifications.

It is because its generally lower-interest rates, while the proven fact that a credit assessment otherwise underwriting isnt required for just one to be considered

We frequently come across website subscribers exactly who think the 401(k) to get the initial lodge after they you prefer more funds. However, i think about this impression are mistaken, particularly if a person has usage of domestic equity within a great realistic rate. On top of that, particularly an assumption can result in expensive mistakes in case the book finances is not considered. On this page, I’ll inform you why so it misconception can be so popular and things to believe ahead of borrowing from the bank out of your 401(k).

However, before taking out people debt, wonder if for example the expense you may be financing is practical. Could you be much better from slowing down, or preventing the expense totally? It’s important to live within a person’s means, as well as for those who keep household security otherwise vested equilibrium funds on your own 401(k), you ought to prevent borrowing out of this resource.

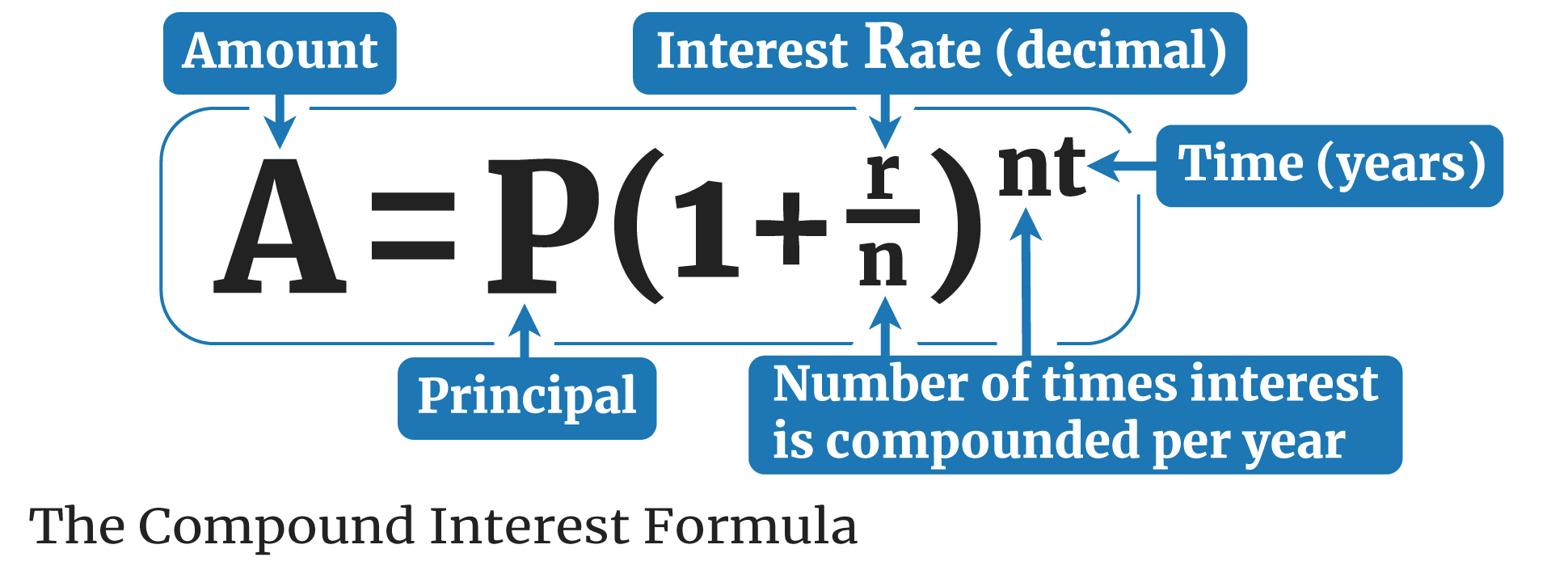

Anyone have a tendency to understand 401(k) money as the an initial-possibilities option when credit an enormous amount of money. Brand new Treasury Regulation step 1.72(p)-1 necessitates that 401(k)s fees theoretically reasonable cost for the people financing. Extremely employers understand it just like the Prime Rates and something otherwise several per cent. Ergo, with the current lower prices, 401(k) money arrive within 5 to 6 percent appeal.

Next reason loan places Allgood anybody always take out 401(k) funds is that they are borrowing money from by themselves. They believe they may be able shell out by themselves back and score a great guaranteed five to six % to their 401(k) currency versus taking on a significant loss. This will be particularly attractive after they dont come across themselves more than likely to achieve more 5 to 6 % towards the market.

Quite the opposite, I’ve seen readers timid from refinancing its home loan with good cashout, or tapping house guarantee which have HELOC (House Guarantee Credit line) fund. I am not entirely sure as to the reasons this is exactly, however, In my opinion that lots of people have a goal of sooner or later repaying their a residential property personal debt, and you may retiring personal debt-100 % free.

William features $fifty,one hundred thousand in the 401(k) bundle that he desires sign up for to help with capital their daughter’s medical college or university will set you back. He could be a traditional investor and also the latest $fifty,100 into the a bond loans inside the 401(k), and therefore generates a beneficial 3% go back.

William decides to use-money out of their 401(k) to cover the costs as the, predicated on their opinions, he’ll get the most to have his money through this technique. He will pay off himself within a 5% rate, and that William believes can lead to a complete higher web come back over the years. William was partly proper. Because of the generally borrowing from the bank of himself, he will make a high get back inside the 401(k) than he had just before. Yet not, he failed to check out the long-identity price of both% raise. William need certainly to front side the five% regarding cashflow to expend it straight back. On the other hand, the attention he could be using so you’re able to themselves is not tax-deductible (in lieu of home guarantee money).

Although not, we know one to every day life is loaded with surprises, and affairs manage arise in which a great 401(k) mortgage could be the most useful or only choice

To start with, as attract was repaid toward 401(k), it will become pre-tax taxation currency. Ergo, whenever William reaches old-age and you will withdraws the interest away from their 401(k), once more, it will be at the mercy of taxation charges. Fundamentally, the attention payment is a share to their 401(k) having shortly after-income tax money that does not preserve any kind of the immediately following-taxation properties. As an alternative, the eye percentage was treated while the pre-tax money, and you will William pays ordinary income taxes on a single financing count twice more than.