With respect to resource your property, you to dimensions does not fit all of the. Although conventional choices instance finance, domestic guarantee lines of credit (HELOCS), refinancing, and you may contrary mortgage loans can work really for many people, the newest present rise out-of financing selection particularly house equity investors and you can almost every other growing platforms have made it clear that there surely is an ever growing demand for other options. Discover more about option the way to get collateral out of your home, in order to generate a far more informed decision.

Conventional Possibilities: Advantages and disadvantages

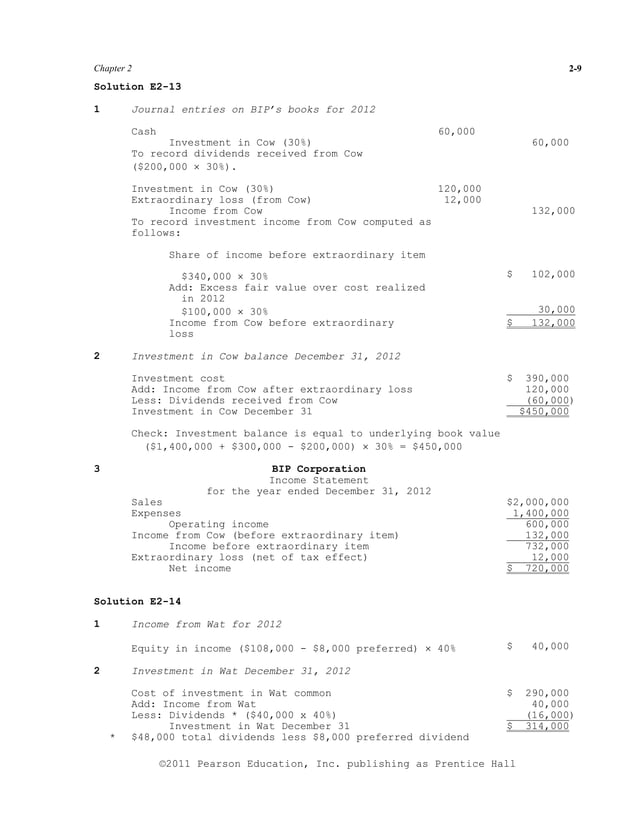

Fund, HELOCs, refinancing, and you can opposite mortgages could all be glamorous a method to make use of the fresh new guarantee you built up of your home. not, you will find have a tendency to as numerous downsides and there’s professionals – therefore it is important to understand the positives and negatives of each and every to understand as to why certain home owners want capital choices. See the graph below so you’re able to quickly contrast financing selection, after that continue reading for much more info on for each.

Domestic Security Loans

A home equity mortgage the most well-known means one to home owners availability their equity. You’ll find benefits, and a foreseeable monthly payment as a result of the loan’s fixed desire price, together with proven fact that you’re going to get the newest security in one lump share fee. Ergo, a house security loan usually is reasonable if you are searching to help you safeguards the expense of a restoration project otherwise highest one-regarding costs. And additionally, the appeal money could be taxation-deductible if you find yourself utilising the money to possess home improvements.

Why identify a property guarantee financing option? Several causes: Very first, you’ll want to pay back the loan including your typical home loan repayments. Of course your own credit try reduced-than-higher level (not as much as 680), you do not also be acknowledged having property equity loan. Eventually, the application process will likely be intrusive, complicated, and you may taxing.

Family Equity Credit lines (HELOC)

HELOCs, a familiar replacement for a home collateral loan, offer quick and easy accessibility money any time you need them. And while your generally speaking you prefer a minimum credit score away from 680 so you’re able to qualify for a HELOC, it can in fact make it easier to improve your score over time. What’s more, you are able to delight in taxation masters – deductions as much as $100,000. Since it’s a credit line, there is absolutely no attention owed if you do not pull out money, and you can take out around you desire until your struck your own maximum.

But with it self-reliance appear the potential for more obligations. Particularly, if you are planning for action to pay off playing cards having large interest rates, you could potentially become accumulating alot more charges. That it actually occurs many times that it’s proven to lenders due to the fact reloading .

Other big downside which can remind homeowners to look for an excellent HELOC option is the instability and you can unpredictability which comes additionally solution, while the variability during the cost can result in changing costs. Their bank may also freeze the HELOC any moment – or decrease your borrowing limit – in the event of a drop on your own credit history or domestic really worth.

Learn how preferred it is to own property owners as if you to put on to have lenders and you may HELOCs, within our 2021 Citizen Declaration.

Cash-away Refinance

One to alternative to a home security loan try a finances-aside refinance. One of the largest advantages away from a money-away refinance is you can safer a lower life expectancy interest on your financial, for example all the way down monthly installments and a lot more dollars to pay for other costs. Or, whenever you can make higher payments, a beneficial re-finance will be a sensible way to reduce their financial.

However, refinancing has its own gang of challenges. While the you happen to be generally paying down your existing financial with a brand new one, you’re stretching the financial timeline and you are clearly stuck with the same costs your taken care of the first time around: application, closing, and you can origination costs, label insurance coverage, and maybe an appraisal.

Complete, you’ll pay between a couple and half a dozen per cent of the total amount your borrow, according to the specific financial. However-named no-cost refinances is deceptive, as the you will probably have a higher rate to compensate. In the event your number you might be credit try higher than 80% of your own residence’s really worth, you’ll likely have to pay getting private financial insurance policies (PMI) .

Cleaning brand new difficulties from app and you may qualification may cause deceased ends for the majority people that imperfections on their credit history otherwise whoever ratings simply aren’t satisfactory; really loan providers need a credit score with a minimum of 620. These are simply a number of the reasons residents will discover themselves seeking to a substitute for a cash-aside refinance.

Reverse Home loan

With no monthly premiums, a contrary home loan are going to be perfect for earlier homeowners trying to find extra money throughout the later years; a current guess on the National Reverse Lenders Association located one older persons got $7.54 trillion tied in a home security. However, you are however responsible for the new commission from insurance rates and you can taxation, and want to remain in the house into life of the loan. Contrary mortgage loans supply an age requirement of 62+, and that legislation it while the a practical selection for many.

There is lots to adopt when looking at conventional and you can alternative a means to access your home equity. Another publication makes it possible to navigate per choice even more.

Searching for an alternative? Enter the Family Guarantee Capital

A more recent replacement family security money are home security assets. The advantages of a house security funding, such as for instance Hometap now offers , otherwise a contributed enjoy agreement, are many. Such investors make you close-quick access into the guarantee you have built in your residence in exchange getting a portion of their upcoming worthy of. At the end of the investment’s energetic several months (and this hinges on the company), your accept the latest financial support by purchasing it that have coupons, refinancing, or promoting your property.

Which have Hometap, also a simple and seamless app process and you can novel certification standards which is usually a whole lot more inclusive than just that lenders, you have some point of get in touch with in the money experience. Probably the key improvement is that unlike these types of more conventional channels, there aren’t any monthly installments or attention to be concerned about for the ideal of the mortgage repayments, so you can achieve your economic specifications smaller. Whenever you are seeking choice the click the link now way to get guarantee out of your home, coping with property security trader might be really worth investigating.

Is actually a Hometap Financial support best house security loan substitute for your assets? Take the four-moment quiz to find out.

We would all of our better to ensure that what when you look at the this information is because the direct that one may by the big date it is blogged, but some thing change easily possibly. Hometap doesn’t promote or screen one connected other sites. Private items differ, therefore consult with your own financing, taxation or legal professional to see which is sensible to you personally.