- Up to $250 pay day loan on your salary and you can a credit-building mortgage around $one thousand

- Rating a checking account no costs, handled paying, credit score record and much more

- Cash return hunting on big retailers

- A practically all-in-one to financial and money progress solution

- Established checking account at the least two months dated

- Regular income dumps

- Checking account suggests a consistent positive harmony

- Fee-free payday loan with recommended tipping

- $/day subscription having advanced functions instance borrowing-building money

What Apps Allow you to Borrow cash?

Of several banks, borrowing from the bank unions and cash progress software give you the means to access obtain money as it’s needed. Payday loan applications will get bank account and you can a career conditions, that will restrict what you can withdraw as an early on member. Distributions usually need a few days in order to process, if you can usually get money instantaneously for a fee.

The lender or borrowing connection may allows you to implement for a loan or payday loan in-software. Ask your financial institution just what mobile credit qualities they offer.

Getting http://www.elitecashadvance.com/loans/1500-dollar-payday-loan a payday advance

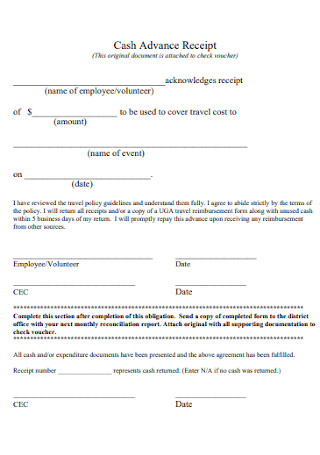

Payday advance functions come online, courtesy programs at brick-and-mortar loan providers. You’re going to have to fill in economic data in addition to income verification, lender comments and you can potentially usage of your savings account.

Wage advance lenders need to know you may have sufficient normal earnings to settle the loan, an optimistic bank balance and you can match spending patterns. When you give your and financial files, this new pay-day financial should determine what properties are available to your and you may discuss payment possibilities, charges and you may interest levels in the the qualities.

How do Glance at Enhances Performs?

A check get better is a little quick-name consumer loan usually paid down on the borrower’s next payday. Examine cash advance, payday loans, payday loans and you can quick-label mortgage all are terms that source a similar tool.

A lender talks about your own evidence of money, always a cover stub, along with your county personality to choose whether or not they often provide to you. The quantity borrowed is born on your own 2nd pay-day, and specific payday loans affairs otherwise possibilities, should be due as much as three months away . Loan providers and charges a share fee based on your own loan amount and you may county rules – usually $15 each $100 borrowed.

When you should Play with Cash advance Apps

Payday loans applications make you entry to their salary early when the you’ve got expense and other crucial costs to pay for. These are typically of good use when you are inside a rigid put and can end overdrafts and other financial costs.

Cash advances was most beneficial when a borrower possess match spending activities, usually covers the costs with more money left and will with confidence repay the new withdrawal and you will one fees otherwise rates of interest.

It isn’t wise to frequently rely on payday loans if you can help it. Specific pay check and money improve features is relatively low-pricing, and others keeps APRs as much as 700%. It may be tough to pay back and you will get over repeating expensive charges. If you were to think your trust payday loans, imagine having a financing conversation with a financial professional to obtain options and you will replace your finances.

Pay day loan programs generally costs profiles deal costs, subscription can cost you otherwise rates with the currency lent. Although some prices is normal, free and you will reasonable-pricing options are starting to be more accessible.

Purchase charges may be an appartment rate or considering once the an optional tip to the provider. Monthly registration charges start in the $1 and you may wade as much as $. Rates are all having old-fashioned cash advance otherwise repayment finance, and certainly will wade of up to 700% Apr.